Height8

24 October 2024

Is e-Invoicing Mandatory for ISPs?

What is e-Invoicing?

Electronic invoicing or e-Invoicing is a system of raising invoices, in which invoices generated by one software can be read by any other software in order to eliminate the need for any fresh data entry or errors.

In other words, e-invoicing uses a standardized format for generating an invoice, where the electronic data of the invoice can be shared with others, thus ensuring the interoperability of data.

Is e-invoicing mandatory for ISPs?

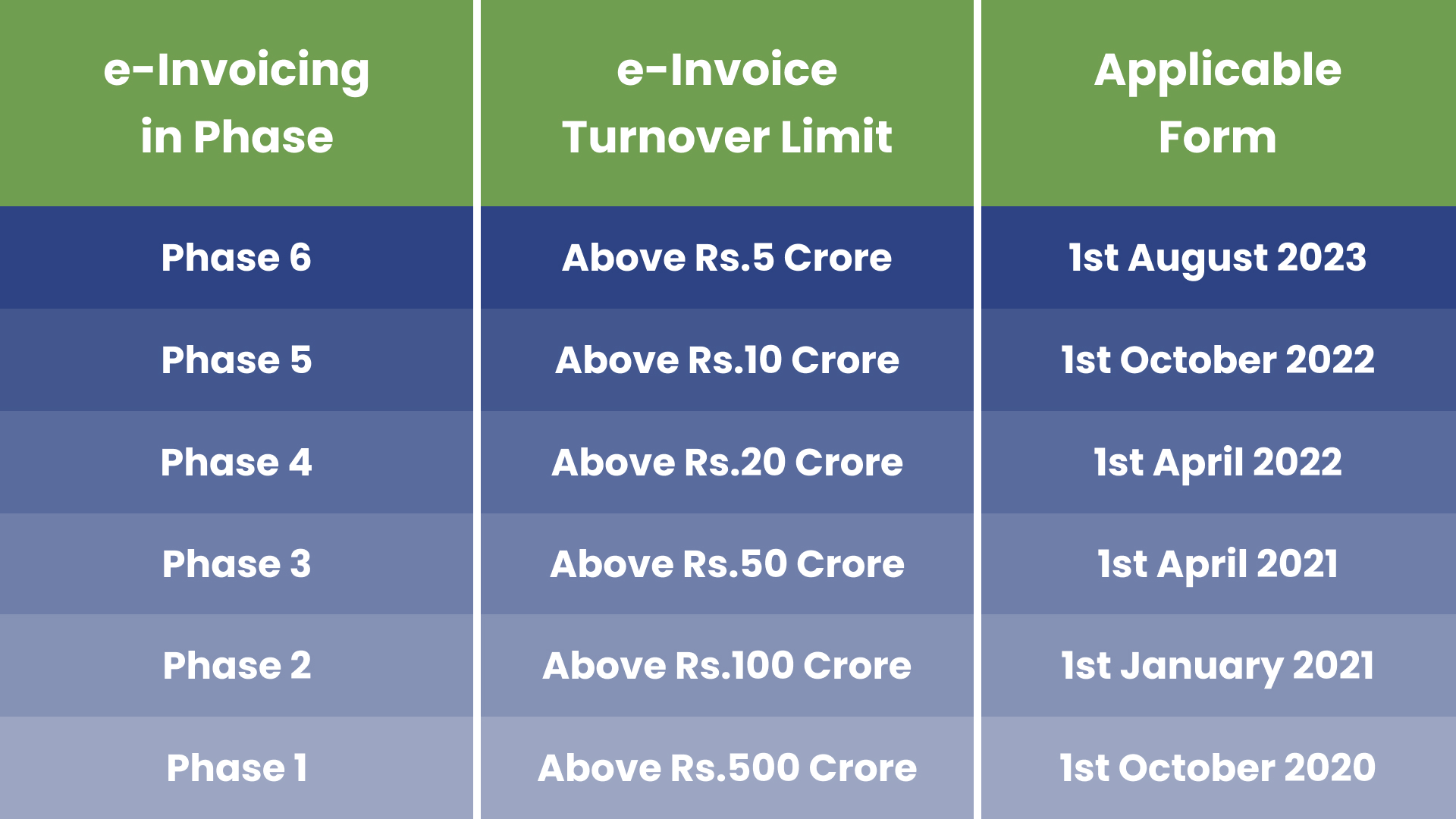

From October 1st 2020, e-Invoicing became compulsory for all businesses including ISPs whose total turnover has exceeded the Rs.500 crore limit in any of the previous financial years from 2017-18 to 2019-20. Afterwards, e-invoicing became applicable to businesses exceeding the Rs. 100 crore turnover limit in any of the financial years between 2017-18 to 2019-20 from 1st January 2021.

Similarly, from 1st April 2021, government extended the e-invoicing applicability to businesses with a total turnover of more than Rs.50 crore. Afterwards, from 1st April 2022, it was extended to businesses having more than Rs 20 crore turnover.

The government extended the e-invoicing applicability to businesses with turnover over Rs.10 crore from 1st October 2022. Recently, from 1st August 2023, it is applicable to businesses with a turnover of more than Rs.5 crore.

e-Invoice Process

Generate the invoice data in the format of JSON in the e-invoice process. This can be done either by using the ISP Management Software or the tool provided by the portal. After that, upload it to the IRP for the validation and authentication of the invoice data with IRN and QR code.

The process to generate e-invoice is mentioned below:

- With the use of ISP Management Software or the tool provided by the portal, generate the e-invoice in a prescribed format.

- Login and upload the e-invoice file to Invoice Registration Portal (IRP). If the software is integrated with IRP via GSP (GST Suvidha Provider), the upload of the JSON file will be automated, meaning system sends the required details directly to the IRP portal.

- The IRP portal validates the key invoice elements and upon successful validation, the invoice data is authenticated with IRN (Invoice Reference Number) and QR code.

- Next, you can download or receive the e-invoice file along with the IRN for the invoices that have been uploaded by you., Using the details received, update your invoice with IRN number and QR code. In the case of an integrated environment of ERP and IRP via GSP, the software will automatically fetch and print such details.

How will Height8 help in e-Invoicing?

H8 Solution is ready with the new e-invoicing feature to follow the steps of the government for digital economy and to simplify the compliances for businesses.

Have any questions or want to know more about the H8 new e-invoicing feature? Write us a mail at h8ssrms@height8tech.com or call/WhatsApp us at +91-6358931775.

Follow us on Facebook, LinkedIn, Twitter, and YouTube to get updates on the latest technological advancements in the telecom sector.